Most people in Toronto (and Canada for that matter) think renting Real Estate is synonym with throwing away your money. I disagree: I think nowadays in the GTA renting is superior to owning from the financial point of view.

I have always liked math, because math is proof. For my own sanity I did some calculations to objectively measure the financial appeal of renting vs owning a Condo.

A Condo? What about the other forms of Real Estate property? Well, I am focusing on a Condo, because that’s where I am planning to live for the next few years. You can do similar calculations if you wish for other types of properties (detach, semi, townhouse, etc.)

I went to Condo.ca and found a unit of my liking (see image below with all the details). This particular unit I can rent for $1,950 a month. The only other money I will need to pay as a renter for this unit is hydro (electricity), since air conditioning, heat, water and parking are already covered by the rental price. If I pay $150 monthly for hydro; then the grand total for renting this unit will be $2,100.00.

Now let’s see how much it will cost me to own this place:

The unit size is 875 square feet (SQ.FT) and the average price per SQ.FT at The Station Condos at this moment is $603; which means the price of this unit is around $527,625.00 ($603 x 875 SQ.FT).

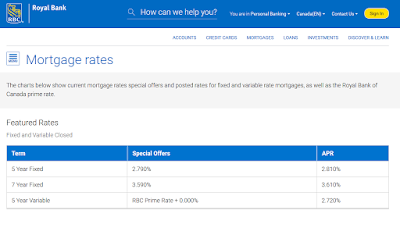

If I put down 20%, then the mortgage amount would be $422,100.00. RBC, my bank, is currently offering a 5 Year Fixed rate at about 2.8% per year. The monthly interest is equal to the outstanding mortgage times the mortgage rate, divided by 12 months in a year: $422,100.00 x 0.028 = $11,818.80 / 12 = $984.90 per month. (This does not include the payment of the principal, it just includes the interest payments of the mortgage)

|

| Mortgage Rates - RBC - April 1st, 2017 |

Now let’s calculate the implicit rent. Say what!?!? "The amount of income you haven’t earned because you have owned your home instead of investing in other things is implicit rent." This is a very interesting concept and it is not trivial to grasp. It is very well explained in The Wealthy Renter – Chapter 4.

To calculate the implicit rent we have to look at the equity we have in our property. Assuming that we just bought with a 20% down payment; then the equity is $105,525.00. We estimate the implicit rent by multiplying the equity by the yield of an alternative investment and dividing by the twelve months of the year. Let’s say my alternative investment is the S&P/TSX Dividend Aristocrats Index. The Yield on this index is about 4%. The implicit rent is $105,525.00 x 0.04 = $4,221.00 / 12 = $351.75.

Currently the monthly maintenance fee (a.k.a. Condo fee) at The Station Condos is $0.52 per SQ.FT. That means the monthly maintenance bill for this unit should be around $455.00 ($0.52 x 875 SQ.FT)

“For homes owned through a condominium corporation, most of the costs of maintenance (but not all) are covered by the condo fee. Still the condo corporation might underestimate the costs of maintenance and end up raising condo fees to make up for deferred maintenance. Or, if they wait too long, they might take a special assessment (a large one-time fee charged to all unit owners) to cover a major repair.” - The Wealthy Renter by Alex Avery.

In the City of Toronto the Property Tax for multi-residential housing is in the range from 0.5% - 1.5% of the assessed value of the property. Let’s assume the property tax for this condo unit is 1% (the middle point in that range) and let’s also assume that the asking price matches the assessed price $527,625.00. That means the annual property tax on the condo unit is about $5,276.25 or about $439.69 on a monthly basis.

The owner of this unit will also have to pay for hydro; all the other utilities are included. Let’s say the cost of hydro is $150 per month (the same amount as if we were renting)

For simplicity I won’t consider other fees like home insurance, title insurance or CMHC insurance (if you buy with less than 20% down payment).

Now let’s put all together:

- Mortgage Interest Payments: $984.90

- Implicit rent: $351.75

- Condo fee: $455.00

- Property Tax: $439.69

- Utilities (just hydro): $150.00

- Grand total: $2,381.34

Finally, let’s compare: renting $2,100.00; owning: $2,381.34. Renting beats owning. You might think the difference is not much, but notice that this number does not include the payments towards the mortgage principal (you still have to pay for that as part of your monthly mortgage payments).

Also, consider what happens if the interest rates move a little higher. Today we live in a world of very low interest rates, which is not normal. As the US FED hikes the rates, the Bank of Canada will eventually hike the interest rates as well. And what that means is that you can expect higher mortgage rates down the road.

Also, consider what happens if the interest rates move a little higher. Today we live in a world of very low interest rates, which is not normal. As the US FED hikes the rates, the Bank of Canada will eventually hike the interest rates as well. And what that means is that you can expect higher mortgage rates down the road.

Also, as a renter you have the flexibility to move in order to chase career opportunities in a moment’s notice or simply move because the neighbor next door is a pain in the derriere.

Also, the renter is not buried in debt. Many (most?) homeowners are buried under a mountain of debt. The funny thing is that many homeowners don’t see the mortgage as debt. Well, I have news: mortgage is debt and it comes with risks; risks a renter does not have.

If you want to dig a little deeper into this topic, consider buying the The Wealthy Renter: How to Choose Housing That Will Make You Rich by Alex Avery. It is a great book on the topic, written as recently as 2016 by someone who (unlike me) is not an amateur. The Kindle version costs less than $5 bucks.

If this article was helpful, please show it by clicking the Google Plus (G++) button at the beginning of this post. Also, feel free to drop a line in the comments section below with your opinion, questions, corrections and suggestions.

|

| The Station Condos Facts - Building Values and Trends - March 28th, 2017 |

|

| The Station Condos Facts - Amenities - March 28th, 2017 |

Nice calculation Yanniel. Just a couple comments....

ReplyDeleteYour assumption that the assessed price is equal to the asking price is invalid (at least in the city of Toronto). The assessed value does not vary as abruptly as the market and the two values are very significantly different. You can probably divide at least by two the tax amount you calculated for the $527,000 property.

$150/month for hydro seems also exaggerated for a 875 square foot condo. That's what I pay for a 2,500 square foot house.

Rent prices can increase really quickly from year to year; just like mortgage rates (rent prices are increasing very quickly in Toronto - not mortgage rates - at least for now).

Nice article and really good point of view from the financial side. However I'd add Toronto/GTA house cost has been climbing year after year. Everyone is predicting a crash in the market that may happen or not. Considering your house even as your only investment is too risky since your not diversifying at all. Let's assume you became a homeowner with no other investments. Selling your house is a big move and can't be a bold one. You have to add 5% commission sales, some reno cost (at least painting and staging), moving cost, etc. The shorter period of time should be equal to the length of your Mortgage agreement so you don't end up paying extra fees. I think 5 years give you a good value already for your house. If market has gone up by 10-15% consistently during last years and no signs to slow down, you can assume that Condo may go up to 1 million. We know that's not totally truth but 750K is not out of the world. If selling you may be netting 150K-180K without sweating.

ReplyDeleteI personally will not buy a Condo unless pre-construction and flip it right after they finish construction. I think if market crashes Condos will get the biggest hit, then houses will stand stronger. As any investment you should not run to sell if market crash and you can hold on payments without drowning yourself in debts.

I bought a house in GTA (Mississauga) 3 years ago and often think of "was this right or wrong decision"? Should I sell or stay? sometimes asking prices and lack of houses in the market make myself dubious about selling or not. Value, maybe not the real value, but the value has gone up by 45-50% in 3 years! It may drop suddenly or keep going. Who knows?

I will know in few years from now how right or wrong I was in 2014.

Thanks for sharing your opinion Yasser. My opinion follows below:

DeleteIt is extremely risky to invest only in one asset. It is even riskier to buy an asset with leverage (by borrowing). It gets worst when the asset in question is extremely overvalued.

Keywords to highlight: “risk”, “one asset”, “leverage” and “overvalued”. It particular “leverage” is very misunderstood. Leverage amplifies gains but also amplifies loses. The bigger the leverage, the bigger the gains or loses. This is why that big mortgage is a double edge risky sword.

Most people in Toronto own just one asset with extreme leverage and at a moment in which real estate prices are the highest ever. I don’t have to wait any time to see the danger in doing this.

You might get lucky by buying a house now and flipping it a few years later. You could make some money in it. Buy the risk you are swallowing is monumental; especially if you have a titanic mortgage and zero other investments. Doing this is as wrong as taking all your money and betting on one horse in one race. You might get lucky, but you are simply asking for disaster.

thanks for helpful share. I think that I prefer to rent a condo instead of owning.

ReplyDelete