I got an umbilical hernia 3 years back and I finally got a repair surgery for it last Friday (November 3rd, 2017) at Shouldice Hospital.

Shouldice is renowned worldwide as the best hospital for hernia repair. Even Google seems to think is the best:

Shouldice is only 10km from where I live; located in a beautiful property in Thornhill, Ontario, Canada (just a few kilometers north of Toronto).

Most of the patients I met at Shouldice where Canadians, but there were some from the US and even as far away as Saudi Arabia. I have been told this hospital has patients from all over the world.

I thought it would be nice to write about my Shouldice experience in my blog; so, here it goes...

Bear in mind that this post is not meant as medical advice of any kind and also take note that what I write here is my PERSONAL experience, which might differ from that of other patients. Also, note that I am not affiliated with Shouldice in anyway; my only relation to this hospital is that of hospital-patient.

The initial medical assessment

It all started one Friday in August, 2017 (don’t recall which exact Friday) when I went for the initial medical assessment.

I went to

Shouldice in the morning around 10am and went home around 2:30pm in the afternoon. Yes, it took quite a few hours to get everything done, mainly because there was a line of people in front of me. (You don’t need a doctor referral for

Shouldice and they offer walking clinic hours for people wanting to have the initial medical assessment; my advice is to go in as early as you can. For working hours check

their website)

You have to fill in some forms with personal and medical information. Then you meet with a nurse that measures your blood pressure, height, weight, wrist size, etc. and also asks some general questions. After that you meet with a surgeon that performs a full physical exam, asks a bunch of medical questions and explains to you what the procedure is all about, the risks associated with it and answers all the questions you might have. Finally, you are routed to a person that will book your surgery date.

I was not pushed in anyway to have the surgery. And they were quite accommodating with my request. I booked my stay at

Shouldice from Thursday, November 2nd, 2017 to Monday, November 6th, 2017.

Basically, you are admitted a day before the surgery and have the surgery on the second day. Then, you stay 3 nights (including the night of the surgery) at the hospital for the recovery.

The initial medical assessment is free of charge and you don’t have to agree to the surgery if you don’t want to.

There is a lot of focus on your body weight during the initial medical assessment. You must meet their acceptable body weight requirements in order to get the surgery at

Shouldice. If you are over-weighted, then you will need to bring your weight down to what they consider to be acceptable. I will write another article dedicated to this topic.

You will have to do some blood work 3 weeks before your surgery (no lab tests are done the day of the initial assessment). You don’t need to come down to

Shouldice to perform the lab tests; you can instead use any Lab and ask them to fax the results to

Shouldice.

Two weeks before the surgery, you have to give

Shouldice a call to confirm your admission.

Day of Admission to Shouldice

I arrived at

Shouldice around 12:30pm on Thursday, November 2nd, 2017. In the reception, I was given a file (folder) with a bunch of papers pertaining to my case, and was told to go to the Lab in the floor below the reception. I was a little bit confused as to why I was told to go to a Lab, when I already did some blood work 3 weeks prior to my admission.

Outside the Lab there were some patients waiting to be called. Not knowing what to do with the file I was given in the reception, I asked around and I was told to simply wait outside the Lab and that a nurse would come from time to time collecting the files. So, I waited and a nurse did come after a few minutes and got my file. She also told me to wait until my name was called.

Eventually I was called inside the Lab. A nurse asked me if I had done some blood work in preparation to my admission to which I answered: yes, I did the requested blood work 3 weeks in advance to my surgery.

The nurse then told me they hadn’t received my lab results and she asked for the name of the Lab that administered my tests. I told her I did my blood work with

LifeLabs and I also told her that I actually saw the test results myself by logging into the

See My Results at Life Labs website.

She then told me not to worry, that she would call

LifeLabs and ask for my results to be faxed to

Shouldice. She managed to request the fax, but after waiting a very long time, the fax never came through. I overhead when a nurse told another colleague the fax machine was queuing 50 something incoming documents.

The nurse then told me the fax somehow got lost and asked me if I could provide the test results by logging into the

See My Results at Life Labs website. They allowed me to use one of the computers in the Lab; so I logged into the system and printed a PDF for them containing the sought-after test results.

I was pretty annoyed by all this delay. I was one of the first patients to arrive for admission and I ended up being the penultimate in getting admitted. Still, I was relieved that I did not have to repeat my blood work just because of a fax that never came through.

The nurse then inserted the printed test results inside my file and handed it to me. Then she told me to go to the end of the hallway and seat. Again, I did not know what to do with the file. I figured somebody would pick it up as it happened before. That was the case, fortunately. Somebody picked the file and told me to keep waiting.

There were some patients before me waiting to be called (patients that arrived after me, but now were ahead of me because of the incident with the fax that never came through). Eventually, I was called in and a nurse asked me a bunch of medical questions (very similar to the ones I was asked the day of the initial assessment). The same nurse also took my blood pressure and weight. Luckily for me, my weight was still perfect!

I took the chance to ask this nurse some questions on behalf of my wife: how will my wife know the surgery has finished? How will my wife know that I am ok ...or not? Is my wife going to be notified after the procedure is done? Can she wait inside the hospital for me to come out of the surgery? How can she get updates about my condition?

The answers to all these questions were rather disappointing. Family members can only be inside the hospital during visiting hours: 2pm-4pm and 7pm-9pm; this applies to the day of the surgery as well, which mean family members cannot wait for you to come out of the surgery. In addition, an emergency contact (in this case my wife) will only be notified in case something goes wrong. No updates are provided. The wife had to wait for the next visiting hours after the surgery for updates.

My wife and I are completely alone (family-wise) in Canada. As you can imagine, it was deeply troubling for her not having news about me. So, I insisted and asked the nurse for a workaround. The nurse then gave me the phone number of my Nurse’s Station and said my wife could call this number and ask for an update. The update would be rather simple, the nurse said, along the lines of: "he got out of surgery, he is ok". That was good enough for me or so I thought (stay tuned).

The nurse left and a doctor (not a surgeon) came in. This doctor asked more medical questions and performed a physical exam. The doctor then asked me to wait outside while she was writing some notes on my file. Shortly after she came and handed me the file. Then, she told me to go to the

Accounts Office upstairs.

I went upstairs and asked in the reception how to make my way to the Accounts Office. Reception pointed me in the right direction and I arrived at the Accounts Office. I waited my turn and then I was attended by a gentleman. I was asked to identify myself by providing my Ontario Health Card. I also provided a credit card for billing purposes and I was asked for my insurance provider (I also provided my wife’s insurance provider).

I had to sign some documents and agree to pay $255 CAD per night (four nights in total) for my stay at

Shouldice. I did so and I was given a wristband with my name, identification number and room numbers.

Room numbers, with an S, as in plural! Basically, there weren’t enough patient rooms that night and 6 of us had to wait for rooms to be vacated in the morning. So, we were sent to the Annex. I was told this is where the original (old) patient rooms were before the more modern rooms were in place.

These rooms in the Annex are not bad to be honest; they could accommodate up to three beds and were cozy. There was only another patient besides me in the room; so we were not lacking space. Still, I was once more annoyed because I had to switch rooms in the early morning the next day. I can’t avoid thinking that the delay with my labs results is to blame for me ending up in the Annex.

Right after the Accounts Office I had one more physician to see: a surgeon. This was not the same surgeon I saw on my initial assessment and it was not the one that later operated on me. The surgeon once more did a physical exam, asked a bunch of medical questions (more of the same) and explained all the risks of the surgery to me.

The most interesting part of this encounter is that at the end of it, the surgeon marked my belly with a permanent market pen. He did so indicating the place where my surgical incision was supposed to take place. I thought this was meant to "show me", but later I realize this is an indication for the surgical team.

|

Incision

site marked – above the belly button

|

After finishing with the surgeon I was conducted to my Nurse’s Station in Level 2. The Nurse’s Station is like the headquarters for the nurses in your floor (level). I was able to glance at the modern patient rooms, given that the Nurse’s Station is in the middle of the hallway where those are located; but shortly after a nurse came to take 6 of us away to the Annex. Bummer :-(

I dropped my luggage in my temporary room, said hello to my roommate and had to go to Level 3 (in the modern part of the hospital) for an orientation meeting. The orientation meeting started at 4:30pm and it was quick. As you can guess, some general information was given by a nurse and a massage therapist gave us a short explanation about the massage services provided at the hospital.

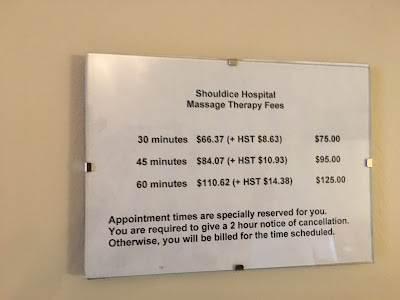

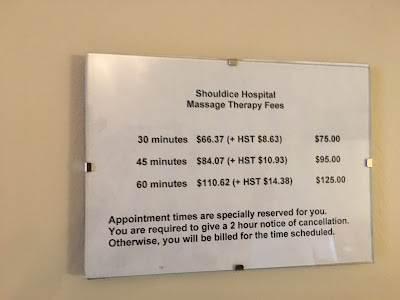

I ended up booking two massages (30mins each) for the two days after the surgery. The massages come out of your pocket, or rather the insurance company's pockets (if you are insured and covered for these kind of expenses). The fees are as follows:

|

| Shouldice

Hospital – Massage Therapy Fees |

What a day! The good news is that it started to get better. After the orientation meeting I went to sit on the lounge in Level 2. There are several patient lounges in the hospital with a nice ambiance, conformable furniture, cable TV, even billiard tables! I waited there for dinner time which is 5:30pm.

At 5:30pm I walked down to the dining room in Level 1 and sat in one of the many round tables and waited to be served. Other patients randomly started to appear and began to sit as well. Conversation ensued. One of them observed: "Hey, you are the new guy!" :-)

All the other guys in my table had the surgery the day before. I was just listening to them as they discussed how they were feeling, the pain killers they were taking, and I paid close attention as one of them explained he was waiting to get his second surgery with just one day in between. Brave man indeed!

Dinner was excellent: a light appetizer, an entree and small desert at the end. The quality was great. It is just enough to feel satisfied without overdoing it.

I finished dinner and still I did not know the time of my surgery the next day. I was told the approximate time of the surgery would be communicated to us after 7:30pm in my Nurse’s station. I had to wait for my name to be called in the audio system of the hospital (you could hear that from everywhere inside the building) and upon been paged (called), I needed to go my Nurse’s Station to receive the news.

Well, I was called at 9pm sharp, which incidentally coincides with the snack time. I stopped by my Nurse’s Station, but the nurse told me: go down to the dining room, grab your snack and be back. She emphasized that the snack would be gone in less than 20mins. So, I went to get my snack.

Snacks are not served; you simply go and grab what you want from what’s available on the tables. The snack was pretty good and there was a decent variety to pick from.

Then I headed back to my Nurse’s Station to learn about my surgery time. Once more I was told to wait. I waited in the lounge in Level 2 just across the Nurse’s Station. Not long after, the nurse called me and some other patients and gave us the news. We were the last batch!

I was number 6th inline (and the last patient) scheduled for surgery with my surgeon. The approximated time for the surgery was from 12pm-12:30pm, and the nurse noted that it could be even delayed up to 1pm. We weren’t supposed to drink or eat anything at all after midnight on the day of the admission, not even water; but given that we were the last batch we were offered a glass of water and some apple juice early morning (around 8am).

I went to bed around 11pm...I was still awake and I noticed the nurse entering the room and removing the glasses of water that we had in our night tables.

Piece of advice and I cannot stress this enough: bring some

earplugs in case you roomie is a snorer.

Day of Surgery at Shouldice

The nurse woke me up at around 6:30 am in the morning. Shortly after, another nurse shaved my belly around the operation site.

|

| Shaved belly around belly button |

Then she told to take a thorough shower and so I did. This would be the last shower in a long time. We are not supposed to take showers after surgery; we are limited to "sponge bathing" the whole body, except the incision.

Bonus tip: having a bowel movement before the surgery would serve you well; this becomes somewhat harder for some patients after the surgery. So, sit in the toilet and do your best to make number 2 prior to taking that shower.

I was provided with a hospital gown and pants (all in blue). You should use these for surgery. No underwear is allowed, but you will use your own socks (make sure the socks are comfortable). No jewelry, no perfume, no body lotions, nothing. You can use some deodorant (I asked!).

|

| Hospital gown |

|

| Hospital pants |

I left the Annex and went down to my Nursing Station in Level 2. Around 8am, I was provided with a couple of tiny juice boxes and some water. This is the only sustenance allowed before surgery for us in the latch batch.

|

Hydration

day of the surgery

|

I waited in the lounge until a nurse came to take me to my new room. Once in the room I met my new roommate, unpacked my luggage and picked some clothes to be worn after the surgery (mainly a pajama and a light sweater). Then I waited...

The wait was long. I was allowed to be anywhere in our level as long as I was in sight of the nurses in my Nurse’s Station. I mainly stayed in my bed.

The nurse came at 12:38pm to take me for surgery. I texted my wife and left my cellphone. I was taken to the pre-operating room. I was asked to rest on a bed and wait. There were other patients waiting as well.

From time to time the surgeon would come taking patients to the corresponding operating room. I waited around 50 minutes and I was taken to my operating room.

I was asked to lie down on the operating table. They put an oxygen mask on me and provided some drug via IV. I remember something cold climbing through my arm and I looked at a round clock on the wall. It was 1:45pm (I think).

There’s music in the room. I remember they were playing a Michael Jackson song, don’t recall which one, but I remember me thinking: "what an irony that they are playing a song of Michael, who died because of anesthesia".

The drug does not put you under completely. This procedure is done under local anesthesia. The drug is to calm you down they say, but in my case it put me to sleep. I remember very little of the whole thing.

I remember some pain when they applied the local anesthesia. Then, I lost track of what was happening.

All of the sudden I woke up with pain; the operation was still ongoing... I remember telling them I was in pain (not sure if I spoke in English or in my mother tongue Spanish). They said something like, "almost there" to which I replied again that I was in pain. I think they applied some freezing again (local anesthesia) and finished the whole thing. Everything was fuzzy in my mind.

I remember being sat on a wheelchair and the surgeon saying to me the hernia was bigger internally than what it appeared to be from the outside. Not sure if I dreamed this or if the surgeon really told me so.

Everything was fuzzy. I know I must have taken an elevator, but I really don’t remember such a thing.

Next thing I remember is the nurse pushing my wheelchair and we were in the hall leading to my room. I remember I was trying to find my wife in the confusion. I knew my wife was there somewhere because I was taken for surgery just about the starting time of the visiting hours. Surgery usually takes 20-30minues.

I remember seeing my wife. She was waiting for me in the lounge and she jumped at me as I was passing. I remember being happy and relieved when I saw her. She told me after I was moving my head from one side to the other like looking for someone. Of course I was :-)

I arrived at the room around 3pm (my wife later told me the time). My roommate was already gutted next to me in his bed. The nurse asked my wife to leave for second so that my clothes could be changed. They took away the hospital gown and pants and dressed me with my own stuff. Yeah, the nurse saw me naked.

They helped me to lie down on my bed and my wife came in. I remember chatting with my wife, but I cannot recall now what about. I remember we took victory selfies :-)

My wife stayed with me until 4pm and then she had to leave. Visiting hours were over at 4pm.

Patients need to stay in bed for 4 hours after surgery. Then, the nurse would come and sit you on the bed for 20mins. If while sitting, you get sweaty, dizzy, nauseating or feel bad in general, then you have to lie down again for another hour and try sitting for 20mins after that. If you feel bad again, then you have to lie down again. This cycle will repeat until you are able to sit for 20mins and feel ok.

Then the nurse will take you by the arm and give you a short walk down the hall and bring you back to the room. If you feel ok after the walk, then you are given green light to walk by yourself as long as you are in your same level.

I never got dizzy or anything. I sat for 20 minutes, did the walk with the nurse and after that I was able to do walk by myself.

|

Sitting for

the first time 4h after surgery

|

Backtracking for a second: my wife left at 4pm and I took a nap. I was given some pain killers at some point, but I don’t remember the time exactly.

I was given Tylenol and Advil alternatively. One time I would take two Tylenol pills of 500mgs and the next time I would take two Advil pills of 200mg each. Some other patients were taking Codeine and OxyContin. Nurses were keeping track of the pain killers you were taking, but they would usually wait for you to ask for the pills.

In later days my routine with the pain killers was: Advil when waking up; Tylenol around 11am; Advil around 4pm and finally Tylenol before going to bed. Tylenol made me feel better than Advil.

At some point after 5:30pm I was brought dinner to the room. I was mightily hungry, and the dinner was very light: some soup, a sandwich, coffee and custard.

I ate it all and remained in my bed. My wife came to visit at 7pm with some friends. I was still in bed. The nurse came shortly after and sat me in the bed. Twenty minutes later the nurse came once more and asked me how I felt. I was great. So, she took me by the arm and gave a short walk at the end of which I ended up in the bed once more.

Visiting hours were over at 9pm and my wife and friends went home. The nurse came around with a snack: a muffin and some juice if I recall correctly.

Dinner and snacks were light on the day of the surgery. Food was much better in later days.

I took some pain killers and went to sleep around 11pm.

Post-Operative Day 1 at Shouldice

I had a good sleep but I woke up on my own accord around 5am. I was feeling a little bit of pain, not much, but enough to keep me awake. I waited on the bed and the nurse came around 6am to wake us up. She provided me with a couple of Advil pills for the pain and a glass of icy water. She also took my temperature and other vitals. I was ok.

At 7:40am I headed down to the dining room in level 1 (one level below) to have breakfast. I took the elevators, but many other patients were taking the stairs. I took the stairs the next day.

Breakfast was great and I was mightily hungry. I picked oatmeal, but there were also other cereals for you to prick from. We had pancakes with syrup, bacon, fruits, coffee, tea, milk, orange and apple juice.

After breakfast I went to the room and waited for the doctor. The surgeons do a daily round starting at 8:30am.

The nurse came just a second before the surgeon and uncovered my bandages. Gross, I know.

|

| Incision uncovered for the 1st time – all the clips still attached |

The surgeon said the incision was looking ok and removed have of the clips. The nurse then covered the incision with new bandages. They didn’t clean-up the wound; they simply removed the clips, took a look and changed the bandages.

|

Incision – half

of the clips removed

|

|

Fresh bandages and thumbs up

|

Then I just enjoyed the place: walking down the hall, sitting in the lounges, calling my family and friends with my cellphone, walking a little bit in the gardens.

At 11am we had our daily session of exercise. All post-operation patients gather in the lounge and a nurse guide us through some gentle exercises. No longer than 15minutes. Very nice.

I asked for pain killers after the exercises. I got used to having them at that time every day. This time I was given Tylenol.

I had the chance to do a number 2 before lunch. Too many details? Well, I bring this up because doing a number 2 is a big deal. Doctors ask specifically if you managed do it. Many patients struggle with this. They get constipated, which in turns gets painful. You are encouraged to ask the nurses for a laxative if needed. I had no problems with this.

Finally, lunch time came at 11:40am. The entree was meatballs and I don’t remember the rest; but it was delicious, I assure you. Food in this place is great.

Time to tidy myself in preparation for visiting hours: well, you are not allowed to take neither showers nor a bath. You are supposed to "sponge bath" all parts of your body, except the incision.

In the patient rooms you have a toilet and a bathroom sink with a big mirror. No showers or bathtubs. Since I did not want to make a mess in the room, I asked where I should perform such a feat as "sponge bathing" myself. Welcome to the

Utility Room!

|

| Utility Room |

Seriously, picture me trying to bath my derrière in that thing. I’ll spare the details and let your imagination take over.

Bathing was hard today. After some brainstorming with my roomie a brilliant solution was born:

baby wipes! Make sure to bring lots of moisturizing baby wipes. You can use these to properly clean your intimate parts (front and back). Believe me when I tell you this advice is worth something. You can wash the rest of your body: hair, face, armpits, chest, feet, etc. in the room’s sink. Use the baby wipes for intimate parts and voila! You are clean! Honestly, I think you should stay away from the utility room.

Then my wife and a friend came to visit from 2-4pm. I showed them around. We even walked a little bit in the gardens. It was a little bit chilly. The fall colors were still hanging by a thread.

|

Shouldice’s

gardens after surgery with wife

|

Visiting hours were over and I asked for my pain killers. I always asked for them at this time. Advil this time.

I took my iPad (and headphones) and went to the only lounge with WIFI close to the reception. I sat in a sofa and watched some Netflix. It was nice. I felt relaxed and comfortable.

At 5:30PM dinner! We were called a little bit earlier 5:15pm into the dining room. I had to eat fast because I had booked a therapeutic massage for 6pm. We had some chicken cordon bleu for entrée. Not joking.

The message room was located in the Annex (where I slept the first day). I had my massage for 30mins. The massage was concentrated around the incision area. It was supposed to be good for me, although I really did not feel any effect.

I then waited once more for visiting hours from 7-9pm. My wife came with some other friends and we chatted in one of the lounges for the whole 2h.

I accompanied my wife and friends to the parking lot and said good bye. During the time I was out of the building they probably announced the Snack time over the hospital audio system, but I missed it. Snacks are called at 9pm sharp each night and they do not last long. I started wondering about the snack at around 9:40pm; by that time it was gone :-( Luckily for me I had some fruits in the room (leftovers from dinner) and I was able to scavenge a coffee in the dining room.

I was not terrible hungry, but I lamented missing the goodies. I waited to 11pm to ask for my pain killers (Tylenol this time) and went to bed.

Post-Operative Day 2 at Shouldice

I had a nice sleep once more, but somehow the night seemed longer. At around 4am, the effect of the pain killers was wearing off. Later I realized the night was longer indeed, since Daylight saving time just ended.

The nurse came around 6am, gave me the Advil with icy water, and checked my vitals. This second day after surgery would be quite similar to the one before; so I’ll try to simplify the story.

Worth mentioning is that the surgeon removed the remaining clips. It seems they noticed something not so great with the healing of my wound, because they asked me not to do sudden movements and to take it easy. They did not provide me with more explanations; that sucked.

|

| Incision uncovered for the 2nd time – just before removing all the remaining clip |

They covered the incision once more with new bandages and left. Unfortunately, I could not take any pictures on this day after they removed the remaining clips.

Same routine as the day before for the rest of my day: breakfast, exercises, bathing (used

baby wipes this time!), lunch, massage, afternoon visiting hours, dinner and snacks.

I had the therapeutic massage at 12:30pm this time. It was somewhat better than the day before because they concentrated in the neck and shoulders; as opposed to the incision site.

I asked my wife not to come to visit at night; since I was supposed to leave in the morning.

And, I did not miss any meals this day!

The rest of the day I was just walking around; chilling in the lounges, watching Netflix, taking selfies in the gardens.

I took my pain killers with the same schedule as the day before.

The day ended and I went to bed.

Day of Discharge from Shouldice

The nurse came earlier at around 5:30 am. She checked my vitals and gave me the pain killers with icy water. She mentioned we should pack and that we should go home today pending the doctor’s approval.

The hospital gets less busy during the weekends, because there are no new admissions on Saturday (surgeries are only done during weekdays). What this means is that on Saturday a batch of patients go home, but no one is admitted until Sunday and Monday. So, on Saturday the hospital was kind of empty. On Sunday, fresh patients arrived and more on Monday.

I packed my belongings and went down to the dining room to have breakfast for a last time. After this, I went to my room and waited in bed for the doctor.

The doctor undressed the wound, said "good enough to go home" and asked the nurse to apply new bandages. From what I gather, my wound was not healing as well as you could expect; but it was not a big deal either. They asked me to keep those bandages dry all the way to Saturday. Not changing bandages, no showers. Everything happened so fast that I did not have time to take pictures this time either. Sorry :-(

The nurse gave me some extra bandages to be used only in case I wet the ones I was using. And that was it; I was almost in my way home.

I had to make a short stop in the Accounts Office and so I did. They provided me with a "Sick Letter" for my employer. I was given 30 days of rest (that’s the maximum the hospital can give); but in reality the doctor said I might take less depending on my condition and line of work.

I only took 10 days after the surgery to go back to work as advised by the surgeon on my initial medical assessment. (I work developing software, so much of the day I am sitting).

The Accounts Office also provided me with receipts. They charged me $255/night for the semi-private room. I stayed 4 nights total but they did not charge me the first night that I stayed at the Annex. The surgery itself and medical care was covered under

OHIP since I am Canadian.

The massage therapists had already provided me with receipts for the messages at the end of each session. These are needed for insurance claims in case you are insured and covered for these expenses. Make sure to ask in reception for a referral note from the doctor saying you need the massages; the referral might be requested by the insurance company. Also, don’t wait to the last minute to ask for this referral note. Better ask for it as soon as you finish your massage.

I called for an Uber and 20 minutes later I was at home!

Despite of all my complaints I do think this hospital is great. The staff, the care, the facilities, the ambiance, the food, the cleanness, everything was great. Rest assured I will come back here if I ever get another hernia, BUT let’s hope not.

If you think this article might be useful to others, please share it by clicking the

Google Plus (G+) button close to the title of the post.

Five days after discharge from Shouldice

I have been well during these five days. I stopped taking pain killers on my own accord after the 3rd day. I kept doing the gentle exercises they taught me at

Shouldice. I started walking every day for over an hour in my neighborhood. It is becoming very itchy around the wound.

Today I took my first shower. Hurra! Then I removed the bandages.

It did not look so well. There was some creamy green/yellowish deposit in the wound and I got scared. I smelled the bandages and it smelled like nothing. No smell at all. My wife observed that the wound itself looked ok and that maybe the deposit was just the result of me making the bandages wet with the shower. Remember, the wound was never cleaned after surgery. Most likely there was some dry blood plus whatever antiseptic solutions the doctors applied to it. Then it all got wet and looked like an alien was coming out of me. Well, I am exaggerating now :-)

|

| Five days after discharge from Shouldice - creamy, green, yellowish deposit in the wound - just after removing wet bandages |

I cleaned the wound a little with warm water and soap (not much soap). Then I used some clean towels the nurse had given me the day of my departure to pad dry the incision. Then I stayed in front of the fan for 30minutes waiting for all the water in the incision to evaporate.

|

| Five days after discharge from Shouldice - Incision slightly washed |

The wound did not look that bad after cleaned. There is still some swelling, stiffness, weird colors in the skin around the incision, but it was dry now, no odd liquids or anything coming out of it. The incision seems closed, which is good. I am keeping an eye on it. I will update you guys/gals as I recover. If you have questions, drop them in the comments section below. I'll try to answer the best I can.

For the time being, I am trying to avoid any water or anything in the wound.

Two weeks after the surgery

I stayed at home for 10 days after the surgery and went back to work on the 11th day. My work is not physically demanding; because I sit in front of a computer for most of my working hours.

I felt a little uncomfortable in my first day at work. I was not in pain per say, but somehow I felt not so good. I started taking Ibuprofen and it made me feel better. I took the Ibuprofen just for two days and by the end of my working week I was not taking any medicine.

The discomfort was almost gone by the end of my first working week; which marked my first 14 days (2 weeks) after the surgery. Pictures below:

|

| Two weeks after hernia repair at Shouldice - front close-up |

|

| Two weeks after hernia repair at Shouldice - front |

|

| Two weeks after hernia repair at Shouldice - left angle |

|

| Two weeks after hernia repair at Shouldice - right angle |

I started taking daily showers after removing the bandages on my 5th day at home. I was making sure the water was not too hot (just warm) when cleaning the incision site and I was using just a little bit of soap to clean it.

After removing the soap with the warm water, I was drying myself with clean towels and then sitting in front of a fan for 10mins so that all the water would evaporate from the incision site. I made my effort to keep it as dry as possible.

It has been very itchy around the incision site. Not just the incision, but all around. The swelling in the belly is reduced now, but not completely. The belly has still some irregular shapes because of the remaining swelling.

I can cough and move around with no pain; which is good. I have been even riding my static bike daily.

In the days I spent at home after the surgery, I used to take daily gentle walks in the neighborhood for up to an hour and a half.

Three weeks after the surgery

I feel much better 3 weeks after the surgery. I am doing my daily static bicycle routine for over an hour and lots of walking. I am even doing some weight lifting (albeit not much) when doing grocery shopping and taking the garbage out.

I shed the scab that had formed around the incision and inside the belly button. No more gross stuff. The belly button is very clean inside-out.

The swelling has been reduced considerably and the scar is smoother.

All and all I feel very positive about my surgery and my recovery up to this point. I feel that the area in which the hernia used to be is becoming stronger and healthier by the day.

It is still somewhat itchy all around the incision. Do you see the rash just under the incision? Well, that was me scratching that area unconsciously.

|

| Three weeks after hernia repair at Shouldice - front |

|

| Three weeks after hernia repair at Shouldice - left angle |

|

| Three weeks after hernia repair at Shouldice - right angle |

Four weeks after the surgery

I feel good. I am doing pretty much everything around the house from changing the winter tires to moving the furniture around. I began lifting my dumbbells (starting with 10 pounds) and I’ll keep adding pounds until I reach my pre-surgery lifting weight (30 pounds each dumbbell). I keep biking indoor for an hour or so most days of the week.

I was able to dance at my company’s Christmas party, exactly one month after the surgery. Not that I dance a lot; but the beers helped!

I don’t feel any pain around the operation site. Only when I apply pressure with my fingers in the area I feel a little uncomfortable. I can tell that the muscles under the belly are still healing and are a little stiff. The belly shape is not as smooth as before, but there is some swelling still. I am not as itchy as before.

|

| Four weeks after hernia repair at Shouldice - front |

|

| Four weeks after hernia repair at Shouldice - left angle |

|

| Four weeks after hernia repair at Shouldice - right angle |

Next pictures coming two months after the surgery! Stay tuned.